How to Open a FAB Bank Account in 2025?

Imagine opening a new bank account in just minutes, with zero paperwork, right from your phone — no branch visits, no hassle. That’s exactly what FAB bank (First Abu Dhabi Bank) aims to offer in 2025. Whether you’re the UAE resident or non-resident, the future of banking is mobile, instant, and accessible. Want to start saving, get paid, or manage your finances smarter? Let’s walk through how you can open a FAB bank account in 2025 — the easiest, most up-to-date guide you’ll find. Ready to take control of your money? Keep reading.

Expert Tip: Once your account is active, you’ll want to check your FAB balance swiftly — whether via FAB balance check, FAB balance enquiry, or FAB bank balance check — so you always know where you stand.

Eligibility, Account Options & Document Checklist for FAB Bank 2025

Before diving into the step-by-step, let’s cover what you need to know first: which account types of FAB offers, eligibility, pros & cons, and required documents. This gives you context, so the actual process is smoother.

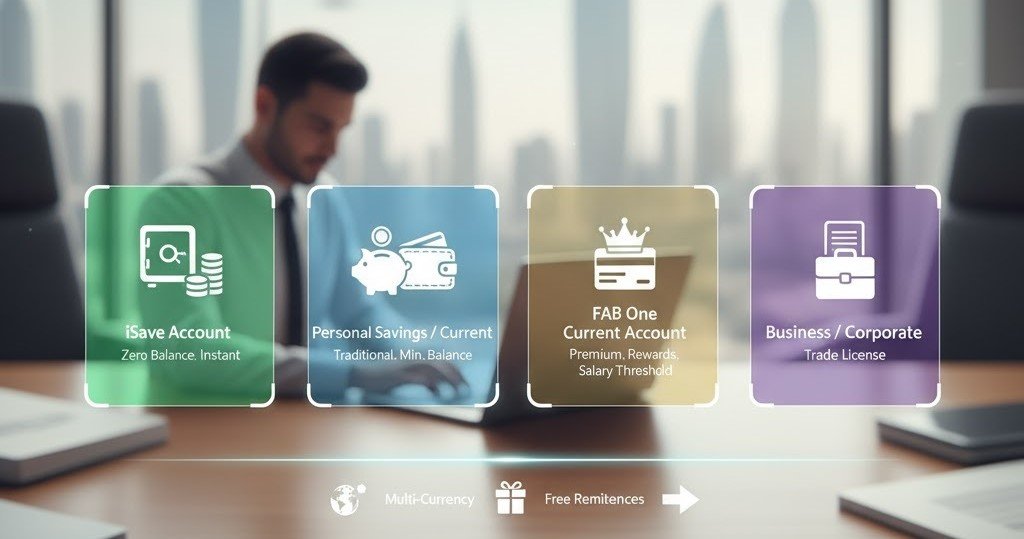

1. Key FAB Bank Account Types in 2025

- iSave Account: A zero-balance savings account you can open instantly via FAB Mobile or online. No minimum balance requirement.

- Personal Savings OR Personal Current Accounts: Traditional accounts that might require a minimum balance, depending on the variant.

- FAB One Current Account: A premium account that also offers rewards but typically has minimum salary or deposit thresholds.

- Business OR Corporate Accounts: For businesses, with additional requirements (trade license, company docs, etc.).

Each account has its benefits and conditions (some offer multi-currency, rewards, or free remittances).

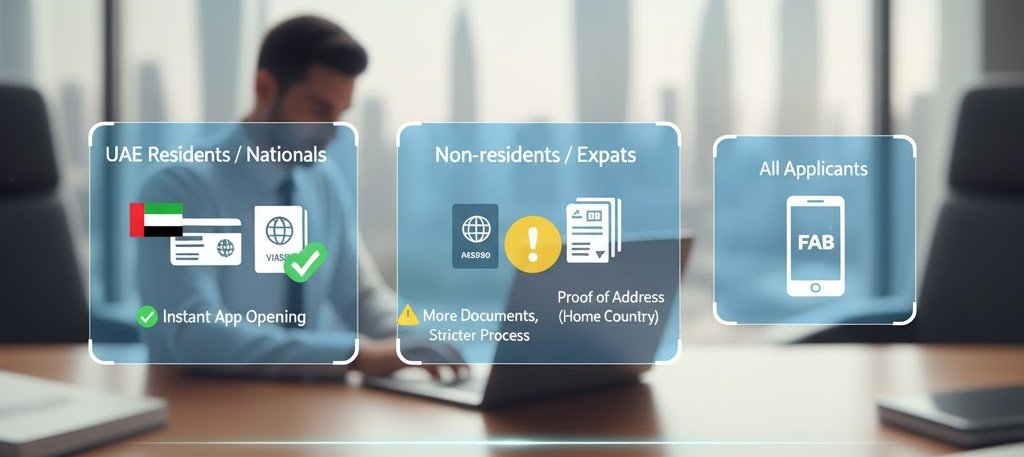

UAE Residents OR Nationals: The simplest case. If you have an Emirates ID, passport with a visa stamp, etc., you can often open accounts instantly via the app.

Non-residents OR Expats outside the UAE: You can still open certain accounts (savings, deposit), but the process is more stringent. You’ll likely need additional proof, bank statements from your home country, etc.

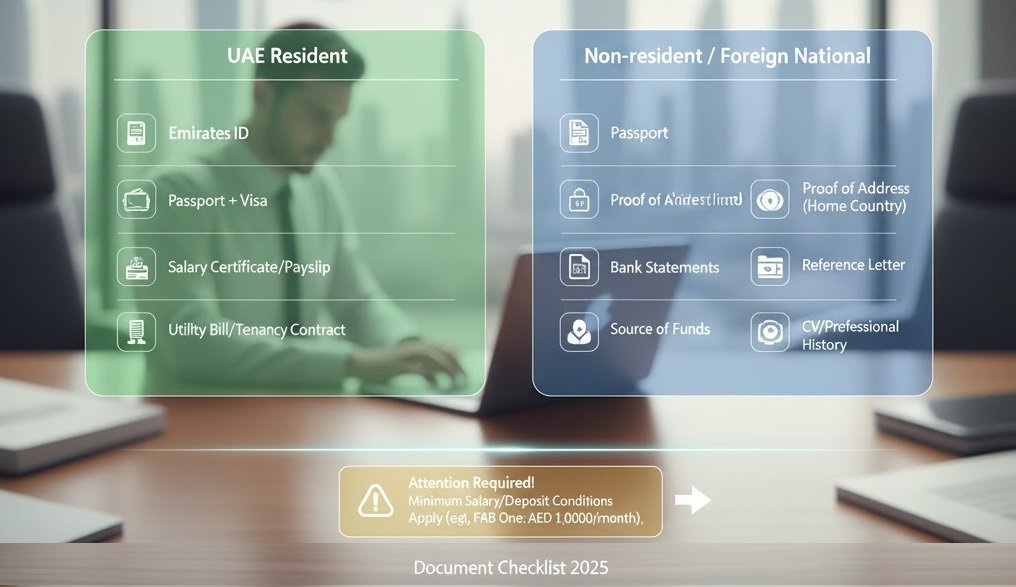

3. Documents & Prerequisites (Check Your Status First)

| Your Status | Must-have Documents |

| Resident / UAE holder | Completed account form, Emirates ID (original + copy), passport + visa stamp, proof of income (salary certificate or payslips), proof of UAE address (utility bill, tenancy contract) |

| Non-resident/foreign | Passport, proof of address in home country (bank statement, utility bills), recent bank statements, reference letter, proof of source of funds or income, CV or professional history |

Attention Required!

Please note that opening some elite or salary-linked accounts may require a minimum salary or deposit condition. For example, FAB One may require a minimum monthly wage of AED 10,000.

4. Timeline & Caveats

- The time to open a FAB account “from scratch” can be anywhere from 2 weeks to 1.5 months, especially for non-resident or complex applications.µµ

- For UAE residents with an Emirates ID, you can often open certain accounts instantly with µzero paperwork via the FAB Mobile app.

- Always check the terms and conditions, fees, and minimum balance rules of the particular FAB account variant you choose.

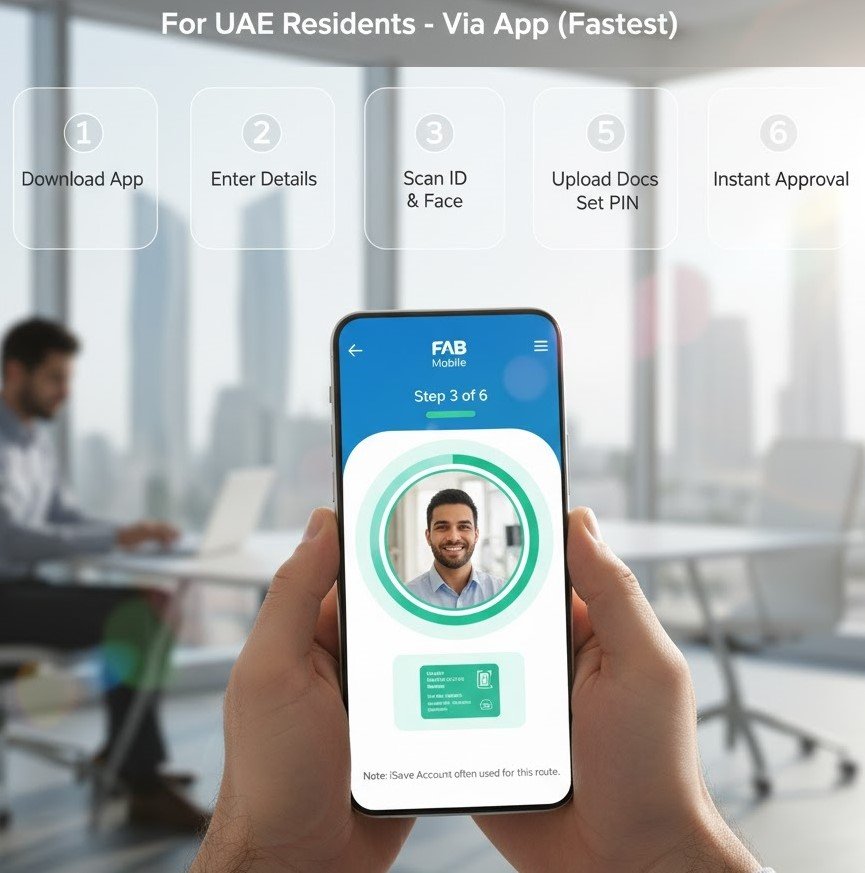

First: For UAE Residents, FAB Online Bank Account Opening — via App

- Download the FAB Mobile app (iOS / Android)

- Register OR Sign up: You will be asked to enter personal details, your Emirates ID, etc.

- Scan your Emirates ID & perform a face scan for identity verification (biometric).

- Upload documents as required (if needed). The app usually guides you.

- Set your app password or PIN and finalise registration.

- Get Your Account Details Instantly: Once verified, the account is active (for supported account types).

Note: The iSave account is often used for this instant, zero-balance route.

Second: For the UAE Residents — Branch OR Traditional Route

- Visit a FAB bank near me and request an account opening form.

- Fill in the form with your personal details.

- Present all required original documents + photocopies (Emirates ID, passport, proof of address, salary proof).

- Submit the documents; the bank may request additional checks (KYC, AML).

- Once approved, your account becomes active. You may receive a debit card, cheque book, etc.

Third: For Non-Residents OR Expats outside the UAE

- Determine which FAB bank account type allows non-resident opening (usually limited savings or deposit accounts).

- Contact FAB (via email, website, or branch) and request the account application package.

- Fill out the form and gather required international documentation (passport, address proof, bank statements, reference letters).

- Submit via courier, embassy attested or as instructed.

The bank will review, ask questions if needed, and upon approval, activate the account.

Fourth: Post-opening Steps (After Account is Active)

- Link Your Salary (if applicable): Some FAB bank accounts give perks when your salary is transferred.

- Set up online or mobile banking and enable notifications.

- Order your debit/ATM card (if offered).

- Fund your account (deposit money) if an initial deposit is required.

- Monitor your account and use the FAB balance check methods to stay updated (online, ATM, app, etc.).

What to Do Next & Encouragement for FAB Bank?

By following the above, you should now be able to open your FAB bank account in 2025, whether instantly via app (if you’re a resident) or through the more classical route (for non-residents). Once your account is live:

- Download the FAB Mobile app and always keep it active.

- Explore All Services: transfers, cards, international remittances, rewards.

- Always check your balance and monitor transactions using FAB balance enquiry, FAB online balance check, FAB bank balance check, or FAB bank salary account balance check online, to ensure there’s no fraud or error.

- Take Advantage of Any Benefits: Rewards, zero fees, linked services and more.

If you get stuck at any step, FAB’s customer support or branch staff can guide you further.

FAQs – FAB Bank

Final Thoughts

In conclusion, opening a FAB bank account in 2025 is faster, simpler, and more accessible than ever, whether you’re a UAE resident or non-resident. With instant mobile onboarding, zero paperwork, and smart digital tools, managing your finances takes just minutes. Stay proactive by regularly checking your balance, exploring account features, and using the FAB Mobile app to make the most of your modern banking experience.